Pulse Check: Operating environment for tourism 2025 versus 2024 – update

ETOA’s Pulse Check asks one question each time. It’s a rapid and straightforward way to highlight our members’ voices to policymakers and the wider travel industry community.

December 2025

This time we asked our members

How do you feel the operating environment for European tourism has been in 2025 compared with 2024?

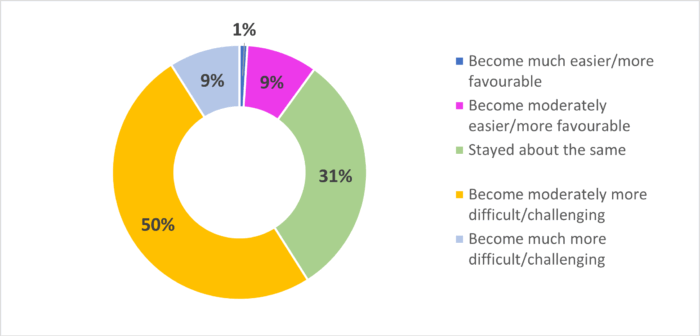

Overall, our members say that 2025 has been a challenging year in terms of operating in Europe. Sentiment towards the 2025 operating environment amongst ETOA members has remained largely unchanged since we last asked, in March 2025. There has been a small increase in the number who feel things have become more difficult in 2025 (57% in March versus 59% in December) and a correspondingly-sized decrease in the number who feel things have got easier (12% versus 10%). The proportion of members who feel the operating environment is the same as 2024 remains unchanged at 31%.

When asked what changes could improve business success into 2026, members primarily cited simpler entry and visa processes as having the biggest impact. The topics where there is most opportunity for improvement in 2026 are:

Entry, Visa & Border Processes

Entry barriers are too complex, costly, and inconsistent, directly suppressing demand. Our members call for simpler, faster, more harmonized visa and pre-arrival and border systems, particularly across the UK, Schengen Area, and in source markets.

Taxes, Fees & Government Policy

Rising and unpredictable taxes undermine forward planning and confidence.

There is opposition to increasing city and visitor taxes, along with calls for uniform tax structures and longer notice periods for VAT changes. Our members ask governments to reinvest tourism tax revenue into the industry and adopt a more supportive stance toward tourism.

Connectivity, Infrastructure & Accessibility

Poor connectivity and access restrictions are increasingly limiting viable itineraries. More direct long-haul flights, improved last-mile infrastructure, easier access to major attractions, and reduced congestion and traffic restrictions, would all help in this area.

Supplier Relations, Pricing & Commercial Conditions

Current supplier practices increase risk and uncertainty for tour operators.

Late release of rates, limited allocations, rising prices, and rigid terms make long-term planning difficult. More realistic pricing, flexible cancellation policies, and collaborative supplier attitudes are needed.

Workforce & Skills Shortages

Shortages of qualified staff, especially long-distance coach drivers, combined with restrictive labour rules are reducing capacity and increasing operational pressure across the supply chain.

Market Development & Demand Stability

Greater diversification and year-round demand are needed for resilience.