Working groups provide opportunity for ETOA’s members and partners to cooperate on issues to do with the business environment for tourism in Europe. They are topic or destination focused. Activities can range from in-person meetings to ad hoc consultation and information sharing.

Their composition is not fixed and expressions of interest are welcome. We try to ensure access to insight from various business models and origin markets, and specialist expertise where applicable. For destination-focused groups, representatives from members’ local offices are especially valuable.

Current activity and priorities

Many of ETOA’s local members are suppliers, and well-informed on local initiatives and political priorities affecting tourism. In addition to organising periodic meetings and social networking events, the working group acts as a forum for confidential exchange and ad hoc collaboration.

Topics generally discussed in the Amsterdam working group:

- Coach Access and parking

- Group restrictions

- Attractions and ticketing

- Accommodation

- Overnight Tax and VMR (entertainment tax)

- Product development

Any new information and insight arising about city access and tourism tax is available via the relevant sections in Operating in Europe menu. For example: tourist tax rates.

Impact of tourism – evidence needed

ETOA is in dialogue with local stakeholders and academics to assemble evidence to challenge narratives about tourism’s alleged adverse impact. For example, that there are no ‘normal’ shops left in the historic centre consequent to tourism, disregarding impact of increasing rents. Anyone aware of current research on topic is welcome to get in touch.

Product development

The group identified the development of non-central product as a priority for operator members who need to diversify their offer, and is working with our industry partner Travel Trade Holland (with whom we share many members) to that end.

Latest Meetings

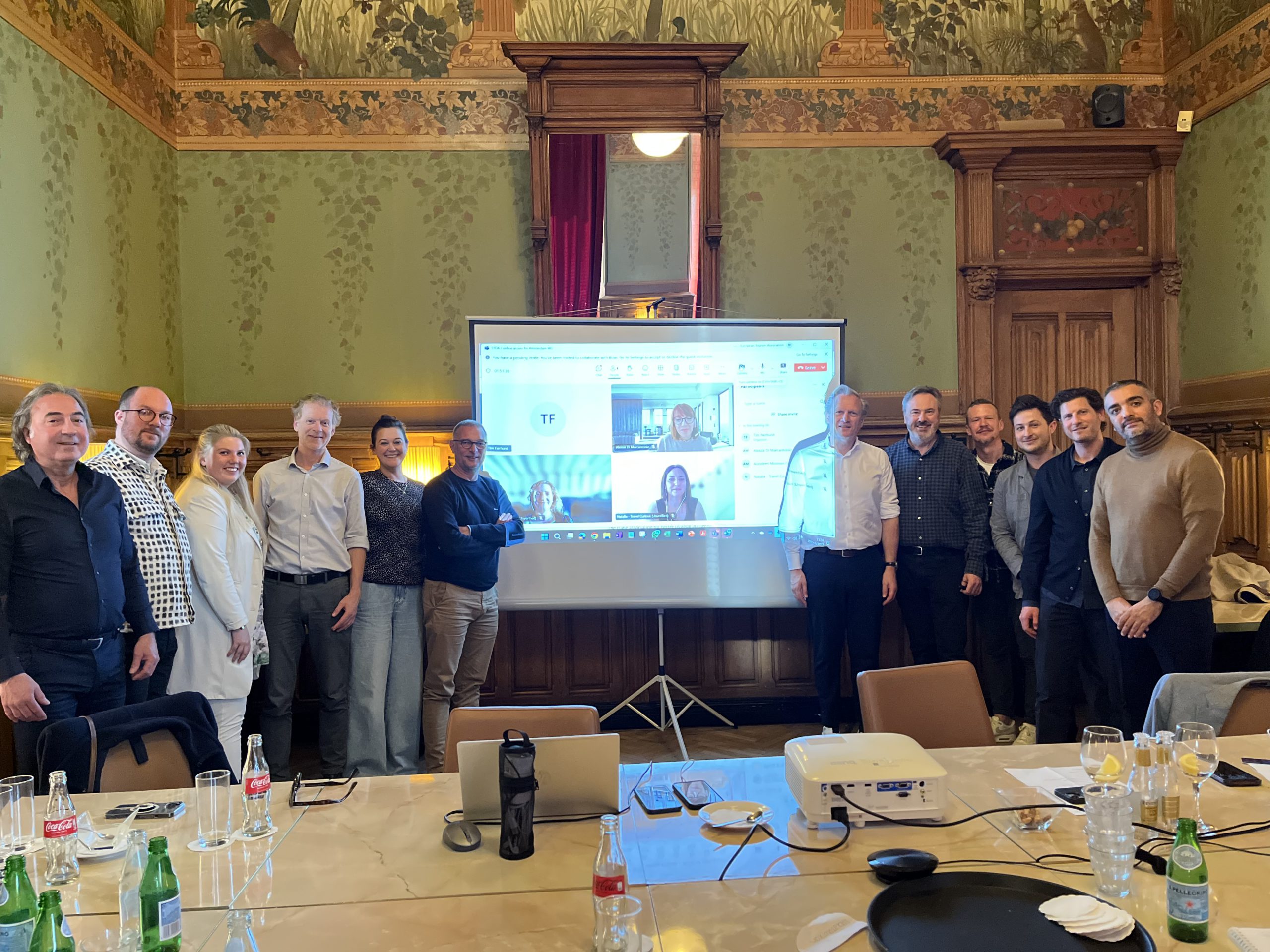

ETOA’s Amsterdam working group was held on 20th March 2025 and discussed the significant impact of the city’s tourist tax on the MICE sector, with a decrease in visitors despite an increase in the average stay. Key issues included jurisdiction limits on product diversification, infrastructure challenges, and the need for improved communication of new offerings and the need for attractions to better engage with B2B clients. Members of the Amsterdam Council attended the meeting and expressed their openness to collaborate on a new tourism strategy aimed at enhancing the overall visitor experience while also benefiting residents.

The meeting held on 23rd September 2024 covered

- Relevance of tourism tax to city budget

- The ‘20MN’ ordening that still needs a coherent implementation plan

- Amsterdam’s Schiphol ability to manage down capacity

- VMR increase that has been indexed to date but may still be subject to additional increase

- MICE business that has been lost due to cost compounded by coach access preventing properties within zone accepting groups business

- 50% reduction of river cruise stops by 2028 that will bring business elsewhere and is already driving product development