Last reviewed 15 November 2024

Turistická daň

The local stay tax (místní poplatek z pobytu) or residence fee (poplatek z pobytu) applies to all types of accommodation at a flat rate per person per day (excluding the day of arrival).

Below are selected destinations and further information can be found by clicking on the name of the destination.

| All types of accommodation (maximum 60 days) | CZK per person, per day (excluding day of arrival) |

Some Exemptions |

| Brno | centre – 40.00 other districts vary from 8.00-50.00 (full list) |

Children under 18 |

| Český Krumlov | 50.00 | Children under 18 |

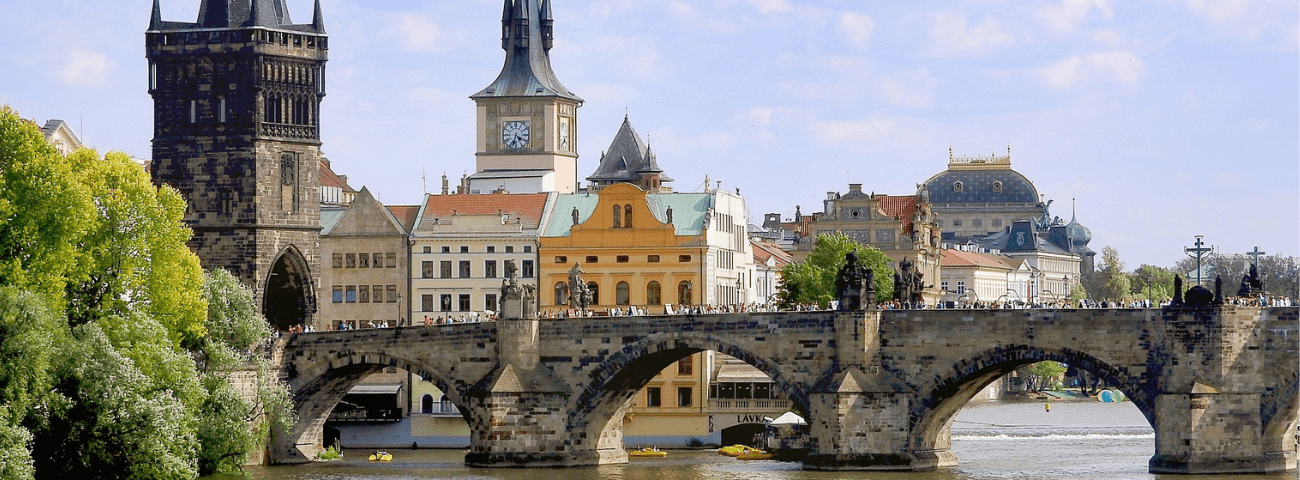

| Prague | 50.00 | Children under 18 |

Disclaimer: While best efforts have been made to verify the accuracy of the information, the information displayed should be used as guidance only.

Keep up to date with levy and tourism taxes – both actual and planned. Find out all about the Turistická daň or tourist tax across the Czech Republic.

This content is exclusive to ETOA members

Not a member yet?

The ETOA membership opens invaluable networking opportunities to your business, allows you to gain access to critical insights and information and contributes to the campaign for a better regulatory environment in Europe.

- Connect with the global travel trade

- Stay informed of insights, regulations and changes

- Be supported in shaping the tourism landscape