Last reviewed 12 May 2025

Taxa Turística

Type: Flat rate per person, per night

Decided by: local governments (municipalities). All municipalities regulate that the tax is levied on visitors staying overnight.

Below are selected destinations. Further (and constantly updated) information can be found by clicking on the name of the destination.

| All types of accommodation | € per person, per night | Some Exemptions |

| Cascais (max 7 nights) |

2.00 | Children under 13 |

| Faro (max 7 nights) (Mar-Oct) (Nov-Feb) |

2.00 |

Children under 13 |

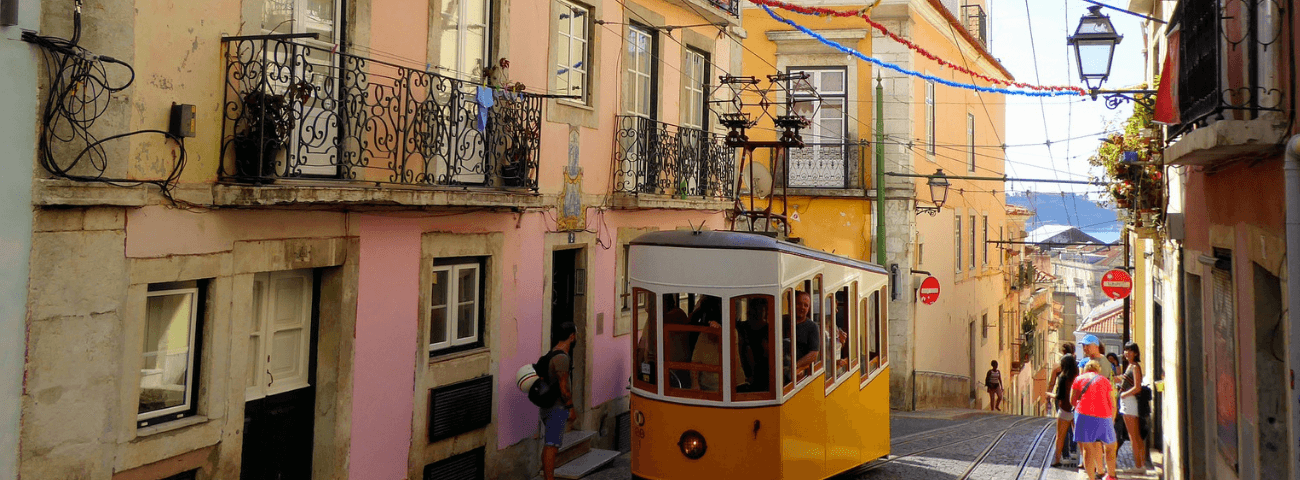

| Lisbon (max 7 nights) |

4.00 | Children under 13 |

| Mafra (max 7 nights) (May-Oct) (Nov-Apr) |

2.40 |

Children under 13 |

| Óbidos (max 5 nights) |

1.00 | Children under 13 |

| Porto (max 7 nights) |

3.00 | Children under 13 |

| Santra Cruz (Madeira) (max 7 nights) |

2.00 | Children under 13 |

| Sintra (max 3 nights) |

2.00 | Children under 13 |

| Vila Nova de Gaia (max 7 nights) |

2.50 | Children under 16, Coach drivers & tour guides accompanying a group |

Algarve region has implemented the tax across all municipalities in the region (including Faro where already implemented) from April 2024. The rate is €2 per person per night April-October and €1 per person per night November-March.

Disclaimer: While best efforts have been made to verify the accuracy of the information, the information displayed should be used as guidance only.

Keep up to date with levy and tourism taxes – both actual and planned. Find out all about the Taxa Turística or tourist tax across Portugal.

This content is exclusive to ETOA members

Not a member yet?

The ETOA membership opens invaluable networking opportunities to your business, allows you to gain access to critical insights and information and contributes to the campaign for a better regulatory environment in Europe.

- Connect with the global travel trade

- Stay informed of insights, regulations and changes

- Be supported in shaping the tourism landscape