Last updated 9 December 2024 | Rates reviewed for all destinations listed.

Turističkoj Pristojbi

The tourist tax (turistička pristojba) applies nationwide. The Tourist Tax Act regulates who is liable and how the revenue is allocated to local and national tourist boards.

The national government determine the band for municipalities to set the rate. For hotel accommodation the band is currently € 1.33-€ 2.65 (Apr-Sep) and € 0.93-€ 1.86 (Oct-Mar). If the municipality decides not to choose a rate between the band, the minimum rate for the period applies. The law states that a rate change must be decided by 31 January for the following year.

Below are selected destinations. Further information (and to check current rate) can be found by clicking on the name of the destination. Other destinations rates can be found here (‘Dodatno’ section).

| Hotel Rates (no maximum nights) |

€ per person, per night | Reductions (50%) | Some Exemptions | |

| 1 April to 30 September | 1 October to 31 March | |||

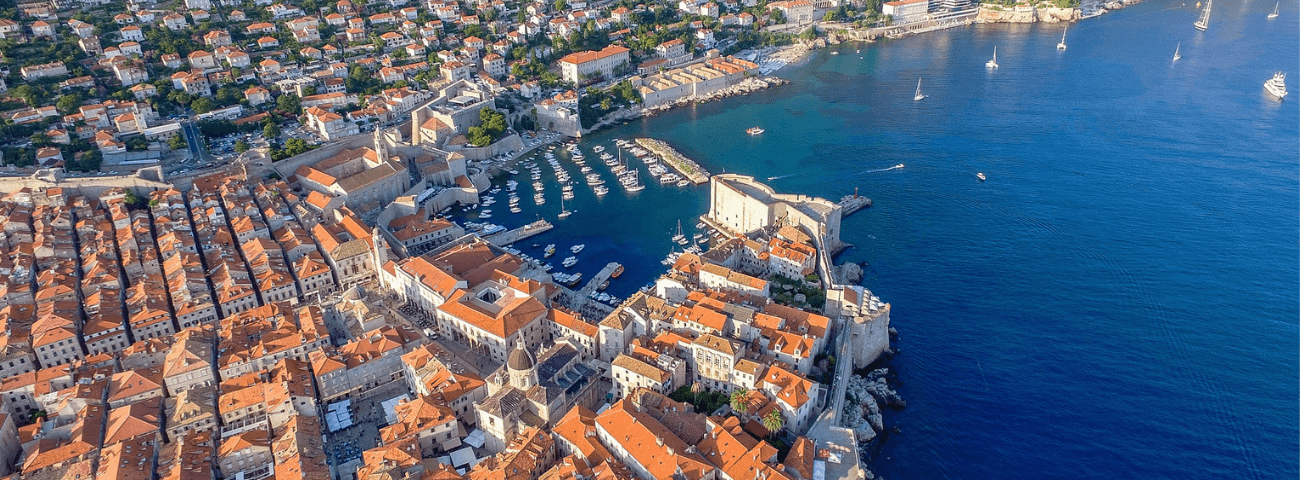

| Dubrovnik | 2.65 | 1.85 | Children 12-17 years of age | Children under 12, School trips |

| Pula | 1.60 | 1.10 | ||

| Split

From 2025 |

2.00

2.50 |

1.86

1.86 |

||

| Zagreb

From 2025 |

1.59

1.86 |

1.59

1.86 |

||

Disclaimer: While best efforts have been made to verify the accuracy of the information, the information displayed should be used as guidance only.

Keep up to date with levy and tourism taxes – both actual and planned. Find out all about the Turističkoj Pristojbi or tourist tax across Croatia.

This content is exclusive to ETOA members

Not a member yet?

The ETOA membership opens invaluable networking opportunities to your business, allows you to gain access to critical insights and information and contributes to the campaign for a better regulatory environment in Europe.

- Connect with the global travel trade

- Stay informed of insights, regulations and changes

- Be supported in shaping the tourism landscape